cumulative preferred stockholders have the right to receive

Choo Cumulative feature Enables stockholders to maintain their same percentage ownership when Retained earnings new shares are issued. Par value is an arbitrary meaningless value assigned to.

Cumulative Preferred Stock Definition Business Example Advantages

Cumulative preferred stockholders have the right to receive adividends in arrears after common stockholders are paid dividends.

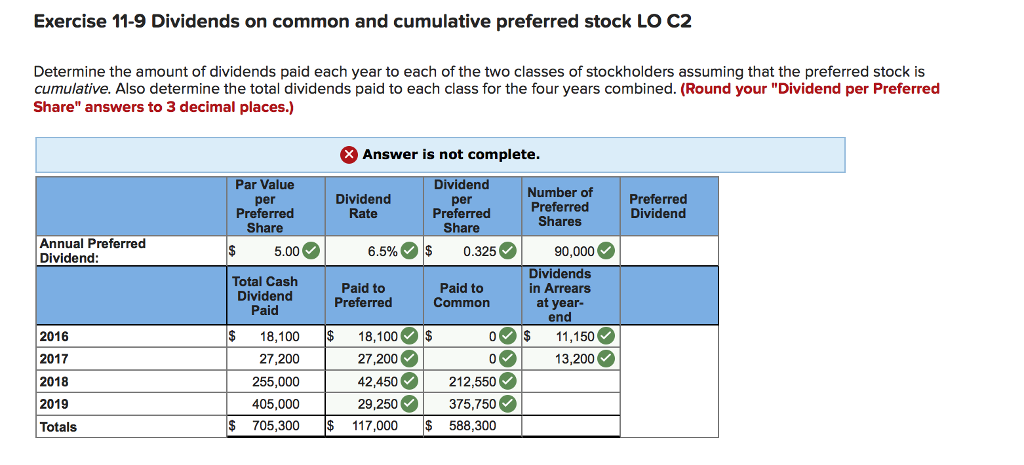

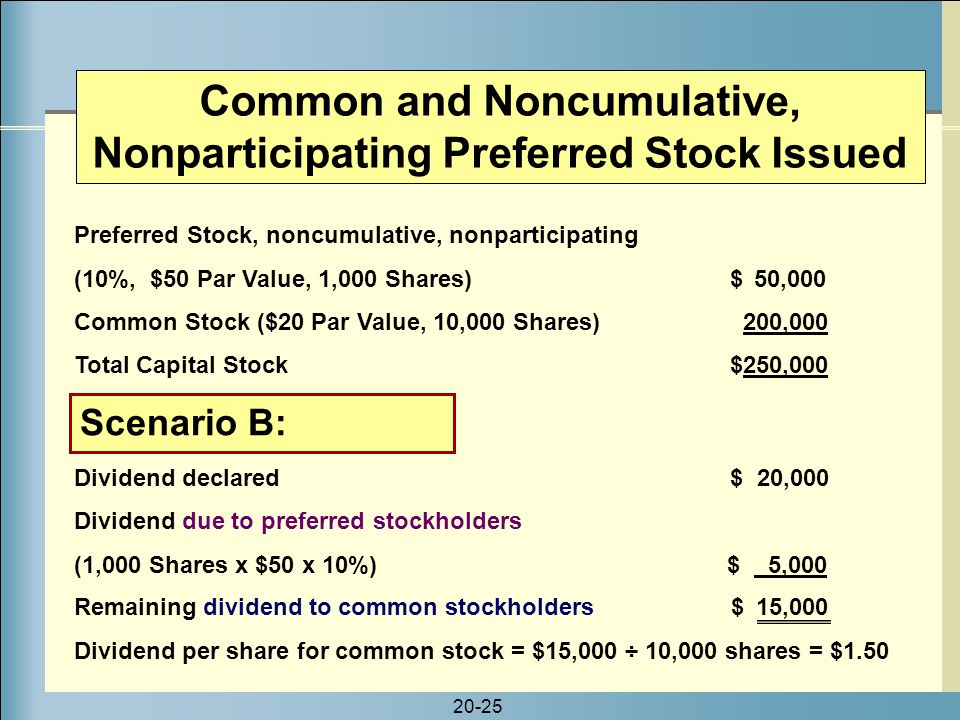

. See also Capital structure. For example a corporation issues 100000 shares of 5 cumulative preferred stock on 1st January 2020 and does not pay any. With cumulative preferred stock the company must keep track of the dividends it chooses not to pay to its preferred shareholders.

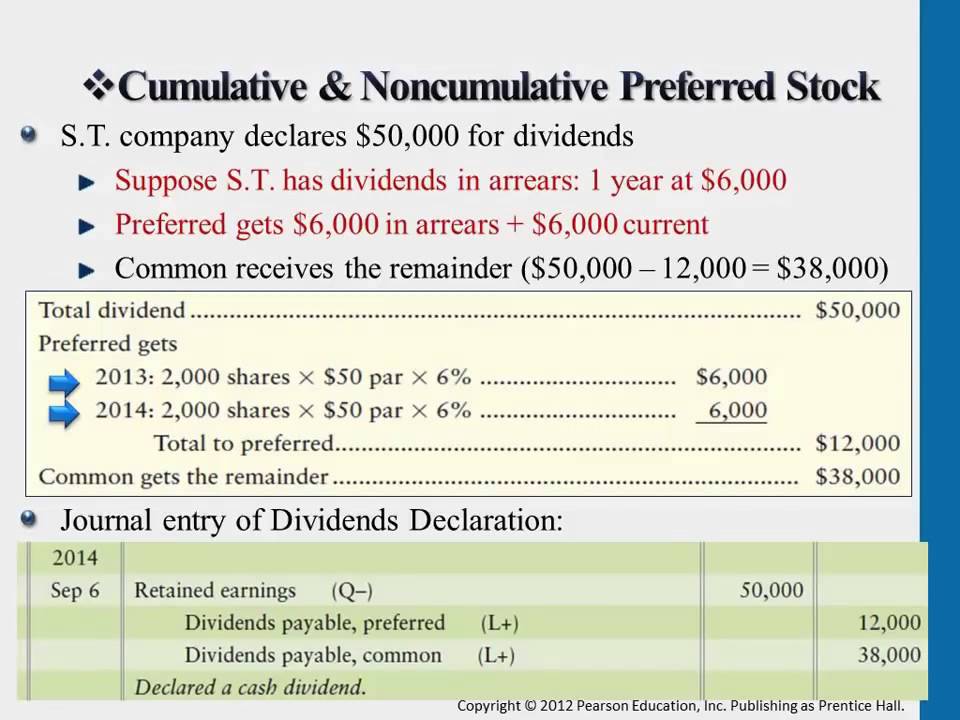

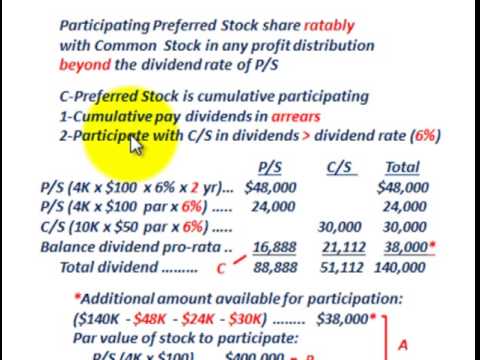

This means that when dividends are in arrears ie dividends are not paid out by the company they continue to accumulate until the dividend is declared. Cumulative Preferred Stock stockholders have the right to receive dividends in arrears their regular dividends passed or not paid in previous years before common shareholders may receive a dividend. The same shareholders have a right to claim any pending dividend payment the issuing company owes them.

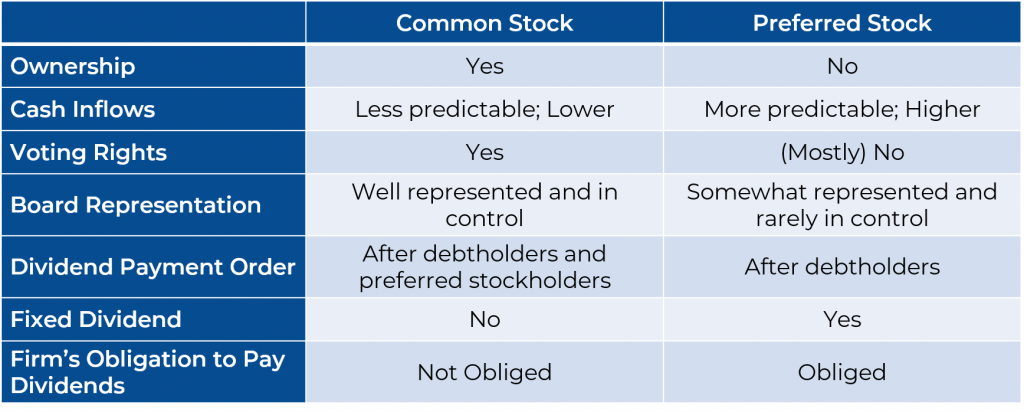

However preferred shareholders usually HAVE NO RIGHT TO VOTE. They have the right to receive a dividend whether one is declared or not. 3 the right to have stock remain noncallable.

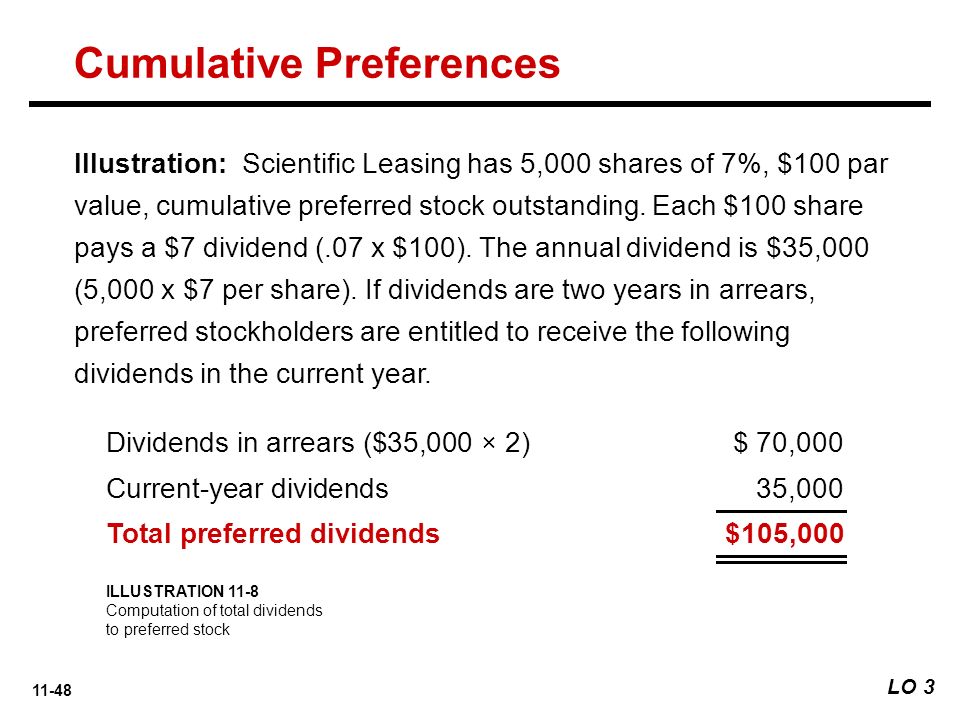

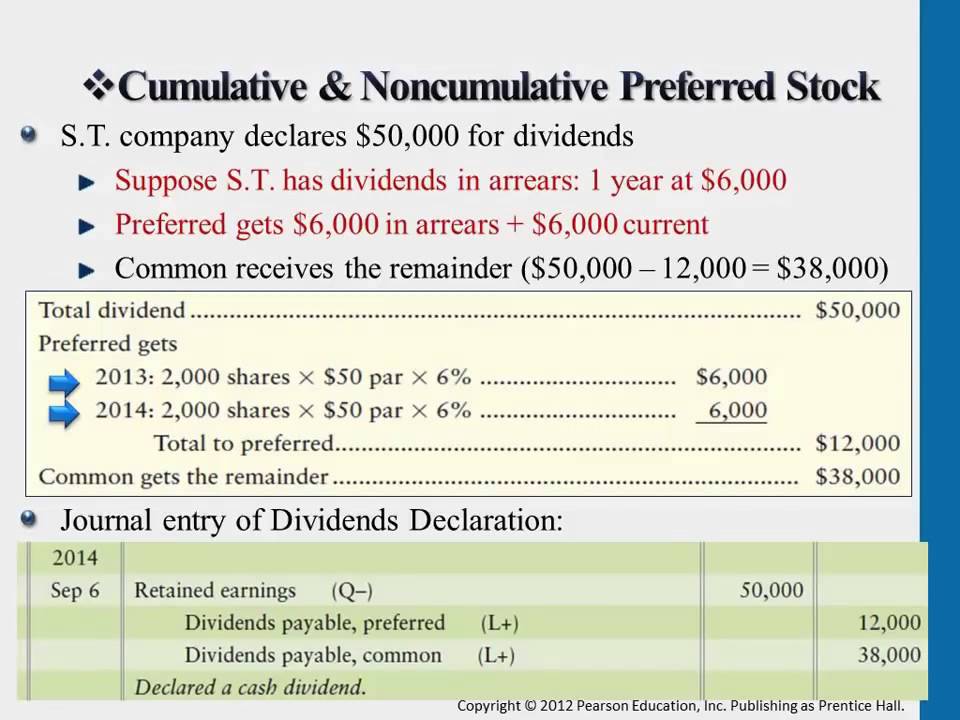

Cumulative Preferred Stockholders are entitled to their preferential right to receive dividends. In addition paying out cumulative dividends doesnt take preference over paying the companys creditors. Essentially the common stockholders have to wait until all cumulative preferred dividends are paid up before they get any dividend payments again.

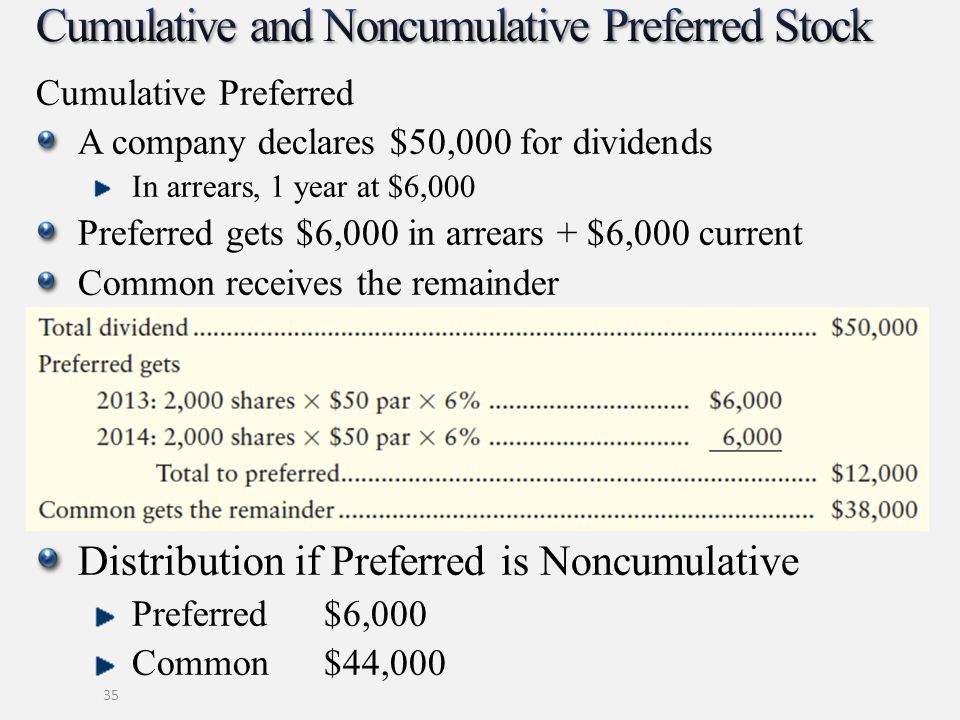

In contrast holders of the cumulative preferred stock shares will receive all dividend payments in arrears before preferred stockholders receive a payment. If a company is unable to distribute dividends to shareholders in the period owed the dividends owed are carried forward until they are paid. In case of cumulative preferred stock any unpaid dividends on preferred stock are carried forward to the future years and must be paid before any dividend is paid to common stockholders.

1 the right to arrears of accrued dividends on cumulative preferred shares. Ba greater share of dividends than common stockholders. Some cumulative preferred shares carry limitations.

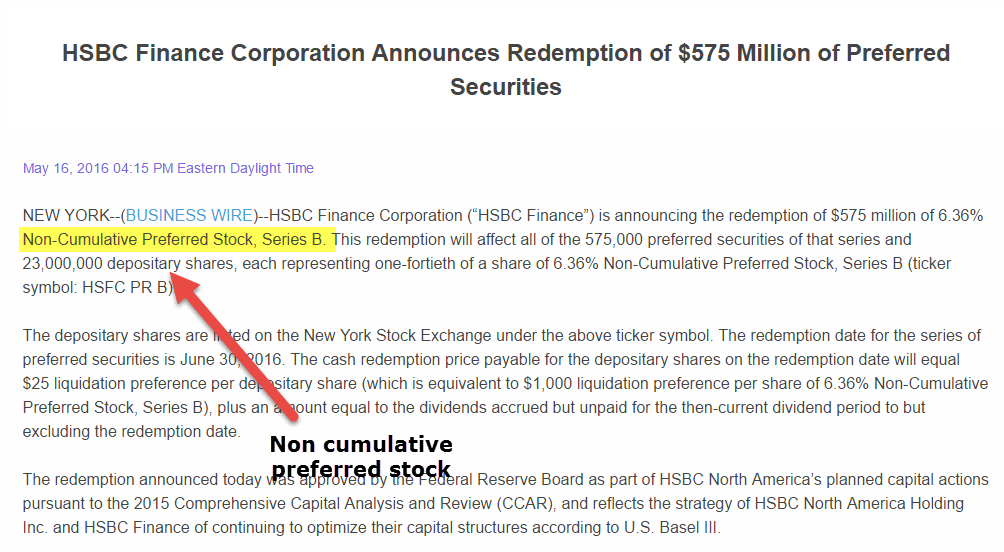

For example if ABC Company fails to pay the 110 annual dividend to its cumulative preferred. By contrast if a company issues noncumulative preferred stock its preferred shareholders have no future right to receive dividends that. A cumulative dividend is a required fixed distribution of earnings made to shareholders.

For journal entries there are 3 important things to know when issuing stock. Cumulative preferred stock is preferred stock for which the right to receive a basic dividend accumulates if the dividend is not paid. Cumulative preferred stocks allow the accumulation of dividends until they are paid.

The INR 60 per share dividend arrears before paying the INR 20 per share dividend for this quarter. Because cumulative preference shareholders are entitled to receive dividends on a regular basis including earlier payouts that were missed the corporation would have to settle all unpaid dividends ie. For example the company may only have to pay cumulative dividends if it liquidates.

It means that cumulative preferred shares are important that the noncumulative. Investors who own cumulative preferred shares are entitled to any missed or omitted dividends. Cumulative preferred stock stock that has a right to receive regular dividends that were not declared paid in prior years deficit a debit balance in the retained earnings account discount the interest deducted from the maturity value of a note or the excess of the face amount of bonds over their issue price dividends distribution of a corporations earnings to stockholders.

Cumulative preferred stock shareholders are treated differently than other preferred stock investors. However cumulative preferred stock shareholders have extra incentives when you look at the order in which shareholders are paid and how they are treated when dividends are missed. Meaning concept importance and.

Have priority over common stock in certain areas such as the right to receive dividends and the distribution of assets if the corporation is liquidated BEFORE common shareholders. However in the case of cumulative preferred shareholders the company has an obligation of ensuring that such shareholders receive all their pending dividends. Non-cumulative preferred shareholders are not.

Preferred shares are the most common type of share class that provides the right to receive cumulative dividends. Cdividends in arrears before common stockholders are paid any dividends. One of these rights may be the right to cumulative dividends.

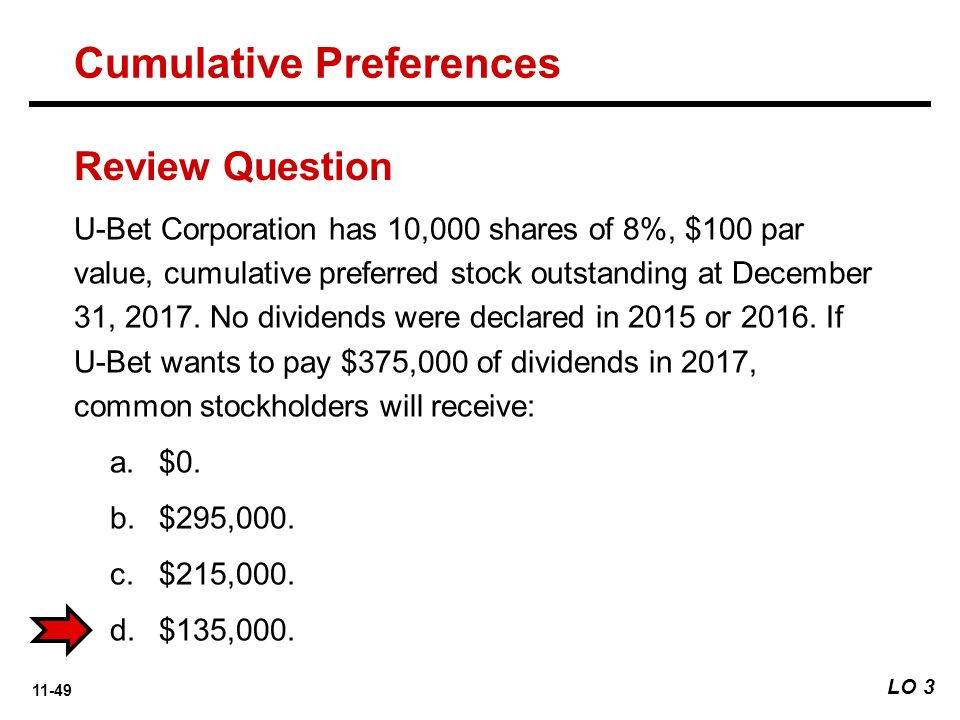

Preferred stockholders have a right to receive current and unpaid prior-year dividends before common stockholders receive any dividends. Once all cumulative shareholders receive. 2 the right to vote for the election of directors.

Preemptive right The amount per share. The cumulative preferred stock shareholders must be paid the 900 in arrears in addition to the current dividend of 600. Preferred stock shareholders already have rights to dividends before common stock shareholders but cumulative preferred shares contain the provision that should a company fail to pay out dividends at any time at the stated rate then the issuer will have to make up for it as time goes on.

It provides a right to claim dividends of the. Cumulative preferred stock. This means that if the company does not declare dividends this year they do not have to pay preferred shareholders the guaranteed dividend amount.

Cumulative preferred stock can receive the dividend even before the stockholders receive their payment. Companies must pay unpaid cumulative preferred dividends before paying any dividends on. DNone of these choices are correct.

Not all preferred shares have the right to receive cumulative dividends. Some of the rights which frequently have been supposed to be vested 9 and so to be immune from the power of amendment are the following. Cumulative preferred stock shareholders are treated differently because they have the right to receive a dividend whether one is declared or not.

Solved York S Outstanding Stock Consists Of 90 000 Shares Of Chegg Com

Preferred Shares Meaning Examples Top 6 Types

11 Reporting And Analyzing Stockholders Equity Ppt Download

Preferred Shares Meaning Examples Top 6 Types

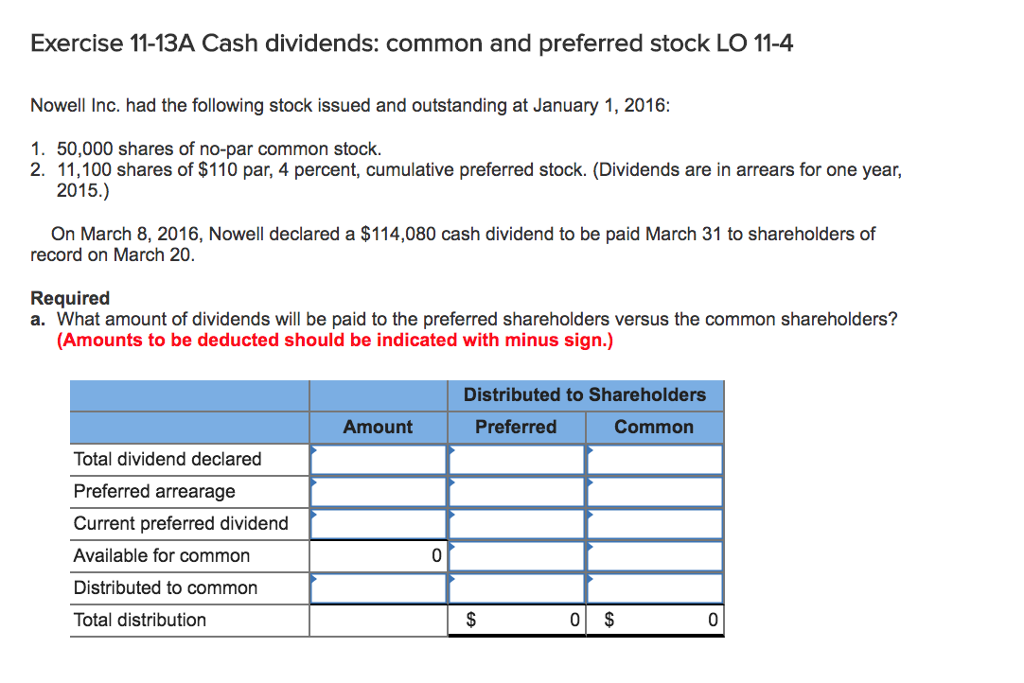

Solved Exercise 11 13a Cash Dividends Common And Preferred Chegg Com

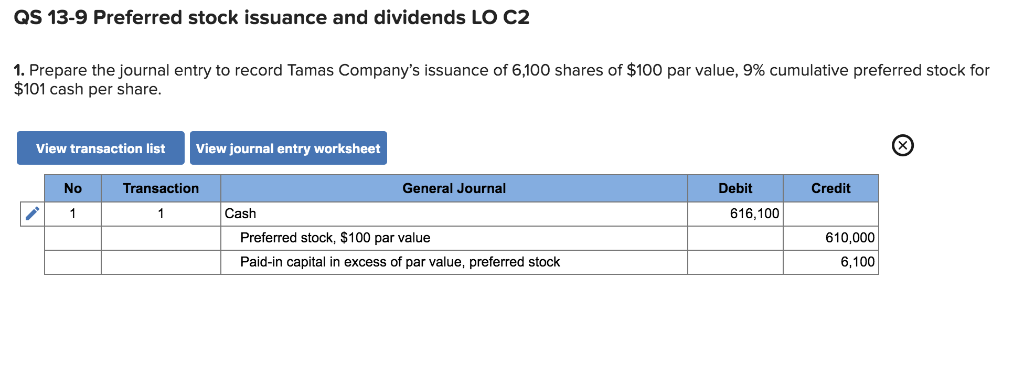

Solved Qs 13 9 Preferred Stock Issuance And Dividends Lo C2 Chegg Com

/book-with-page-about-preferred-stock--trading-concept--814447584-db8f837c330d4d8e9974c345d342867d.jpg)

Noncumulative Definition And Examples

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube

Cumulative Noncumulative Preferred Stock Youtube

Common Stock Vs Preferred Stock 365 Financial Analyst

Common And Preferred Stock Principlesofaccounting Com

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Corporations Paid In Capital And The Balance Sheet Ppt Download

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

11 Reporting And Analyzing Stockholders Equity Ppt Download

Corporations Formation And Capital Stock Transactions Ppt Download

Preferred Shares Meaning Examples Top 6 Types

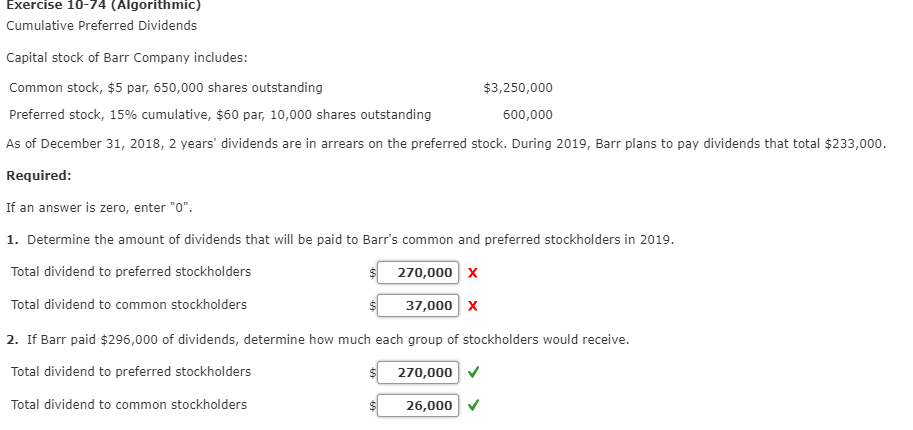

Solved Exercise 10 74 Algorithmic Cumulative Preferred Chegg Com